vermont income tax withholding

If youre a single filer with 40950 or below in annual taxable income youll pay the lowest state income tax rate in Vermont at 335. In Vermont there are three main payment schedules for withholding taxes.

Taxation Of Social Security Benefits Mn House Research

Semiweekly monthly or quarterly.

. The filing status number of withholding allowances and any extra withholding for each pay period is determined from the employees Form W-4VT. If the Amount of Taxable Income Is. Tax Withholding Table.

If you reside in one of the following states you may elect to not have state income taxes withheld by electing No do not withhold state income tax below. Tax Withholding Table Single. NOT have state income taxes withheld even if you have elected federal income tax withholding.

You may pay your Business and Corporate Income Taxes Sales and Use Tax Meals and Rooms Tax Withholding and Miscellaneous Taxes online using one of the following payment methods. The Single or Head of Household and Married withholding tables will increase. If the Amount of Taxable Income Is.

If additional Federal tax was withheld multiply the additional amount by 27 percent and add that to the result of step 7 to obtain the. Tax Rates and Charts. 2015 Income Tax Withholding Instructions Tables and Charts.

Vermont Income Tax Withholding is computed using the Vermont withholding tables or wage bracket charts. 2022 Income Tax Withholding Instructions Tables and Charts. Vermont has no cities that levy a local income tax.

500340 plus 780 of excess over 94200. If the Amount of Taxable Income Is. If the Amount of Taxable Income Is.

The annual amount per exemption has increased from 4250 to 4350. Tuesday December 21 2021 - 1200. State government websites often end in gov or mil.

Over 94200 but not over 193950. Arkansas California Delaware Georgia Michigan3 North Carolina Oklahoma Oregon or. No action on the part of the employee or the personnel office is necessary.

The Amount of Vermont Tax Withholding Should Be. The Amount of Vermont Tax Withholding Should Be. Over 0 but not over 2650.

2015 VT and Tax Tables. The gov means its official. The income tax withholding for the State of Vermont includes the following changes.

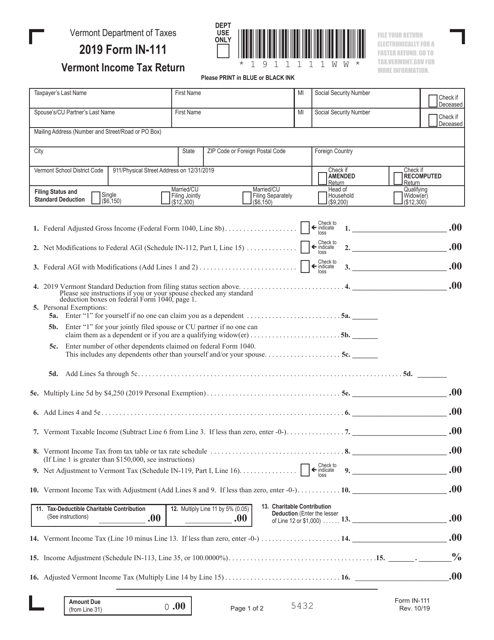

The Single Head of Household and Married annual income tax withholding tables have changed. 2022 Income Tax Withholding Instructions. A reproduction of the 2019 annual percentage method withholding tables begins on page 2.

The Amount of Vermont Tax Withholding Should Be. Arkansas California Delaware Michigan2 North Carolina Oklahoma Oregon or Vermont. It should take one to three weeks for your refund check to be processed after your income tax return is recieved.

The more you withhold the more frequently youll need to make withholding tax payments. 133480 plus 680 of excess over 40250. 000 plus 355 of excess over 2650.

Single or Head of Household. An employee is paid 1800 each week. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

Tax Withholding Table. Tax Withholding Table Single. Her W-4VT form claims two withholding allowances and married status.

The annual amount per exemption will increase from 4000 to 4050. An Official Vermont Government Website. This document is designed to provide you with an overview of the Vermont The Vermont Income Tax Withholding is computed in the same manner as federal withholding tax by using the Vermont withholding tables or wage.

Enter your account number and the routing number of your bank. To NOT have state income taxes withheld even if you have elected federal income tax withholding. Over 2650 but not over 40250.

If you reside in one of the following states you may elect to not have state income taxes withheld by electing No do not withhold state income tax below. Pay Online using myVTax. No action on the part of the employee or the personnel office is necessary.

The Amount of Vermont Tax Withholding Should Be. Vermont withholding is 50938392 x 00660 554 554 4539 5093 Because 162692 falls between 1543 and 3463 the tax is computed as 4539 plus 660 of the amount over 1543. 28 rows This form serves as the transmittal for forms W-2 or 1099 and reconciles the amount.

If Federal exemptions were used and there are additional withholdings proceed to step 8. Divide the annual tax withholding by 27 to obtain the biweekly Vermont tax withholding. The Amount of Vermont Tax Withholding Should Be.

ACH Debit free If you file your return electronically you can submit your payment by ACH Debit. Single or Head of Household. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time.

2016 Income Tax Withholding Instructions Tables and Charts. Department of taxes. The income tax withholding formula for the State of Vermont will include the following changes.

2016 VT Rate Schedules and Tax Tables. Before sharing sensitive information make sure youre on a state government site. If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference.

The Amount of Vermont Tax Withholding Should Be. The Vermont Department of Taxes released its 2019 state income tax withholding tables and guide. If the Amount of Taxable Income Is.

This means that whether you live in Burlington Rutland or anywhere in between you wont have an additional local withholding. Over 40250 but not over 94200. Vermont 2019 income tax withholding instructions tables and charts The supplemental rate is increased to 30 of federal income tax withholding.

File Scheduled Withholding Tax Payments and Returns.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State Income Tax Rates And Brackets 2022 Tax Foundation

State W 4 Form Detailed Withholding Forms By State Chart

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Vermont Paycheck Calculator Smartasset

How Can You Save Money On Income Taxes This Year The Wake Up For Wednesday Jan 12 2022 Cleveland Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Supplemental Tax Rates By State When To Use Them Examples

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Strength In Personal Income Leads Tax Revenue Results Vermont Business Magazine

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)